BNK improves margins and profit – Q1 FY25 trading update

Highlights

- Unaudited underlying profit of $0.784m v loss of $0.396m in Q1 FY24.

- Unaudited statutory profit of $0.273m v loss of $0.55m in Q1 FY24.

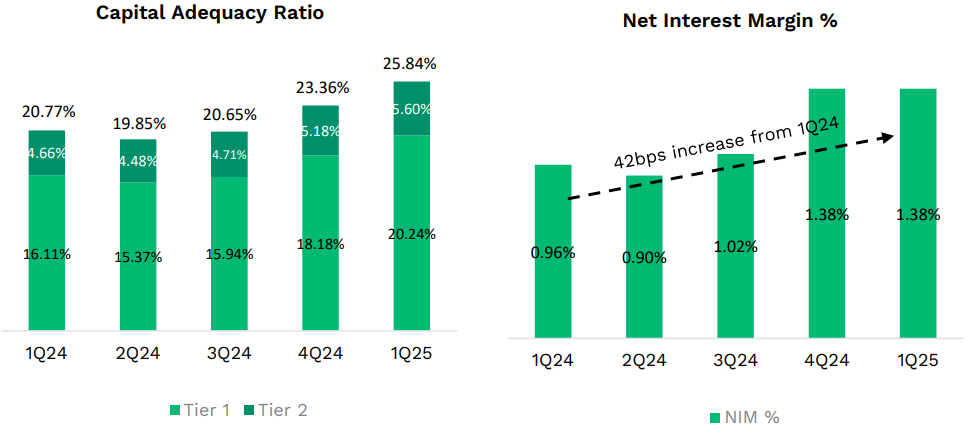

- Net Interest Margin increase of 18bps from 1.20% in 2H24 to 1.38% in Q1 FY25 and up 42bps from Q1 FY24.

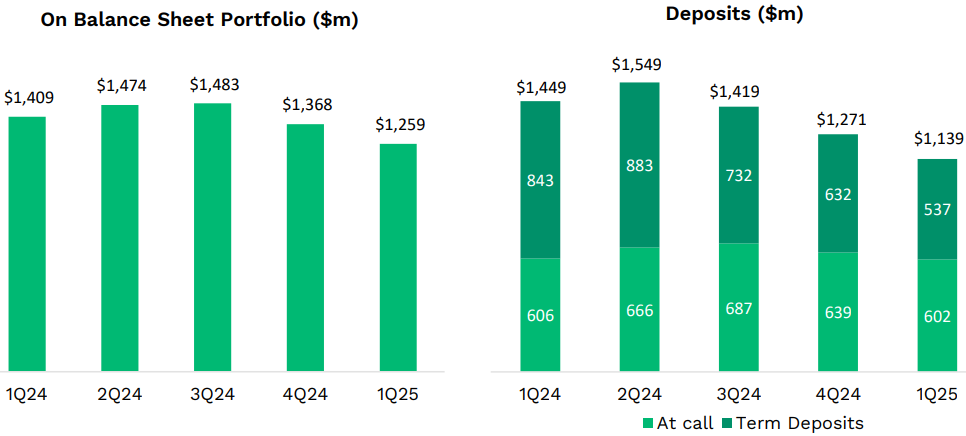

- BNK loan book of $1.3bn, a decrease of 8.0% from FY24, reflecting the shift in portfolio composition.

- Total deposits of $1.1bn, a decrease of 10.4% from FY24, reflecting a mix of 53/47% between Call Accounts and Term Deposits.

- Higher margin lending settlements of $15m with higher margin business now comprising 20% of the loan book.

- Deposit to Loan Ratio of 90%.

- Strong capital position, with a capital adequacy ratio of 25.8%, up from 3.4% at 30 June 2024.

- Off balance sheet Goldman Sachs lending settlements of $133m.

Commenting on the results from the quarter, BNK CEO, Allan Savins, said:

“BNK has intentionally focused on optimising portfolio composition rather than pursuing headline growth over the past year. This quarter’s results demonstrate the continued shift away from lower margin prime residential loans, aligning with the previous guidance to enhance the loan book’s composition.”

“In particular, the improvement in underlying profitability marks the seventh consecutive month of positive (unaudited) underlying profit performance.”

“The resulting total deposit mix reflects our continued focus on margin management as the strategic shift towards more targeted and selective higher margin asset growth reduced the emphasis on expanding deposits during the quarter.”

“This approach, along with improved yields on investments, contributed to a sustained improvement in NIM for the quarter in an environment where we see continued competitive pressures in both lending and deposits.”

“Our strengthened capital adequacy ratio and the healthy balance between deposits and direct loans demonstrate our ongoing capability to attract deposits, supporting growth as required. By prioritising portfolio optimisation, we have also improved capital efficiency to support growth in the higher margin business.”

“We remain focused on controlling our cost of funds and operating expenses, while carefully increasing our presence in the higher margin lending space, staying dedicated to achieving sustainable underlying profitability.”

“Finally, our off-balance sheet Goldman Sachs settlement volumes remained robust, making a significant contribution to the generation of non-interest income for the quarter.”

This announcement has been authorised for release by the Board of Directors.