Trading update | Q3 FY24

Q3 FY24 HIGHLIGHTS

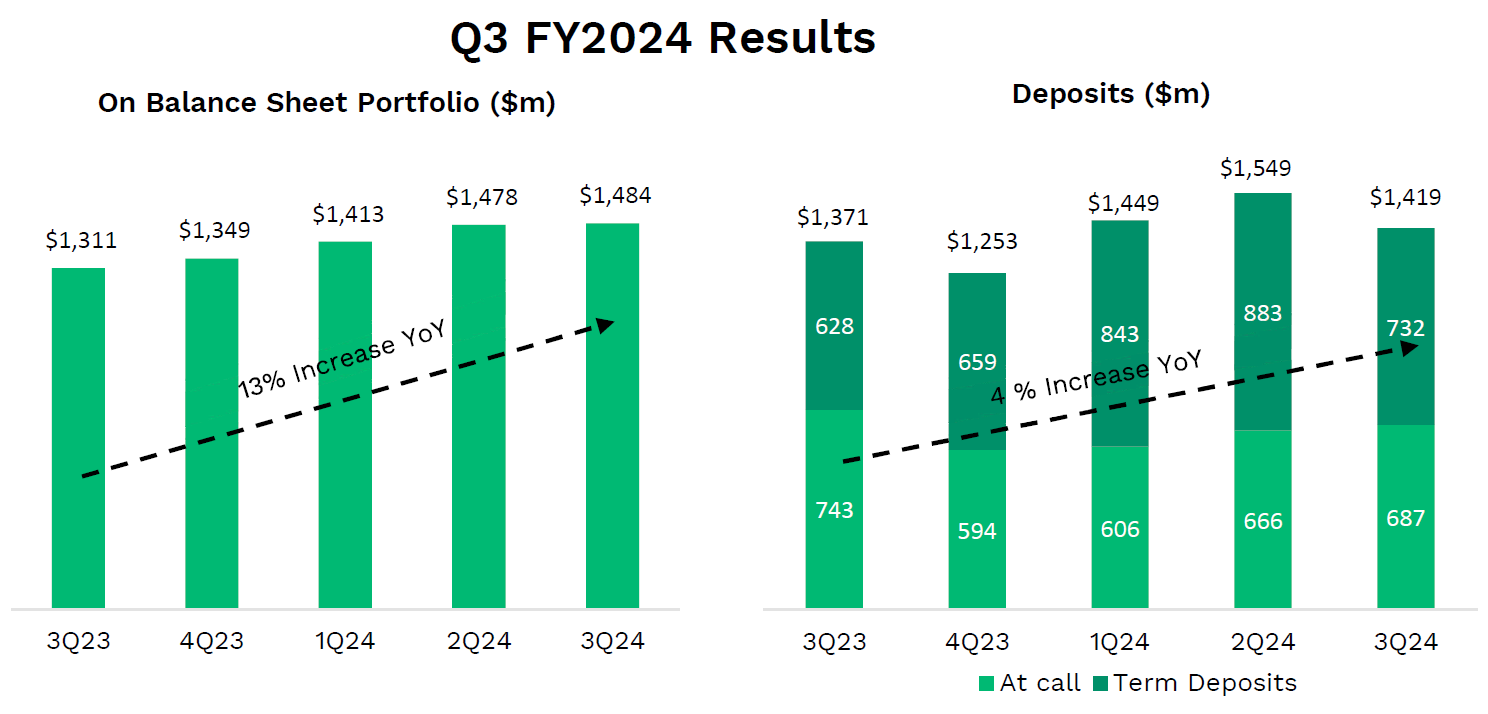

- BNK loan book of $1.5bn, unchanged from Q2 FY24.

- Total deposits of $1.4bn, a decrease of 8% from Q2 FY24, reflecting an improved funding mix.

- Organic and inorganic higher margin lending settlements of $90m, with the acquisition of the Goldman Sachs portfolio of $80m and an increase in organic higher margin settlements of 75% on Q2 FY24.

- Deposit to Direct Loan Ratio of 119%, reflecting BNK’s continued ability to raise deposits to fund growth.

- Well capitalised, with a capital adequacy ratio of 20.7% as at 31 March 2024, up from 19.9% at 31 December 2023.

Commenting on the results from the quarter, BNK CEO, Allan Savins, said:

“We have maintained our high-quality loan book during the quarter, bolstered by the acquisition of approximately $80 million of high-margin, floating rate residential mortgages from Goldman Sachs during the quarter”.

“Additionally, we are pleased to announce that we have now exceeded our target of $100 million in high-margin lending for FY24, despite only being three quarters through the year. This marks our second consecutive year of achieving this target and demonstrates strong results from our continued focus on securing quality loans”.

“The reduction in total deposits, particularly Term Deposits, from Q2 FY24 reflects continuation of a sharpened focus on margin management. Our strategic shift towards more targeted and selective higher margin asset growth initiatives lessened the imperative for overall deposit expansion in the quarter.”

“Our improved capital adequacy ratio and our deposit to direct loan ratio reflects our continued ability to attract deposits to fund continued growth as needed.”

“We will continue to focus on managing our cost of funds and operating expenses, while expanding steadily into the higher margin lending space, and we remain committed to our goal of sustainable cash profitability.”